Play the best casinos

Early in March, President Biden signed off on the long-awaited Executive Order on Ensuring Responsible Development of Digital Assets, a high-profile acknowledgement of the potential of the cryptocurrency industry.< https://blackmoonmarketing.com /p>

“A global approach is needed to maximize the advantages from the underlying technology and to manage the risks,” the paper says. “However, given the different stages of market maturity, the development of regional hubs and the varying capacity of regulators, it is prudent to holistically focus also on the important role that international organizations and national/regional regulators as well as industry actors can play in ensuring responsible regulatory evolution.”

The Governor of Banco Central do Brasil, Roberto Campos Neto, said among the cryptocurrencies being used by Brazilians, local demand had shifted toward stablecoins, with people using cryptocurrencies more as a means of payment rather than just for investment.

.chakra .wef-facbof @media screen and (min-width: 56.5rem) }You can unsubscribe at any time using the link in our emails. For more details, review our .chakra .wef-19rlmqy .chakra .wef-19rlmqy:hover,.chakra .wef-19rlmqy .chakra .wef-19rlmqy:focus-visible,.chakra .wef-19rlmqy privacy policy.

Chainalysis also notes that much of the capital flight out of East Asia is facilitated by the stablecoin, Tether (USDT), a cryptocurrency notionally pegged to the value of the US dollar (USD). Tether became more popular in 2017 following the PBOC’s restrictions on crypto exchanges in China. Trading Bitcoin for Tether was already made illegal by the PBOC’s 2017 prohibition on cryptocurrency exchanges, but it was still possible for Chinese cryptocurrency traders to acquire Tether from discreet trade with over-the-counter brokers or through the use of foreign bank accounts. According to former Grayscale Director of Research Philip Bonello, Tether is especially popular in China because its value is stable from being hypothetically pegged to the US Dollar, making it easier to exchange to the fiat currency of a user’s choice.

Cryptocurrency r

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

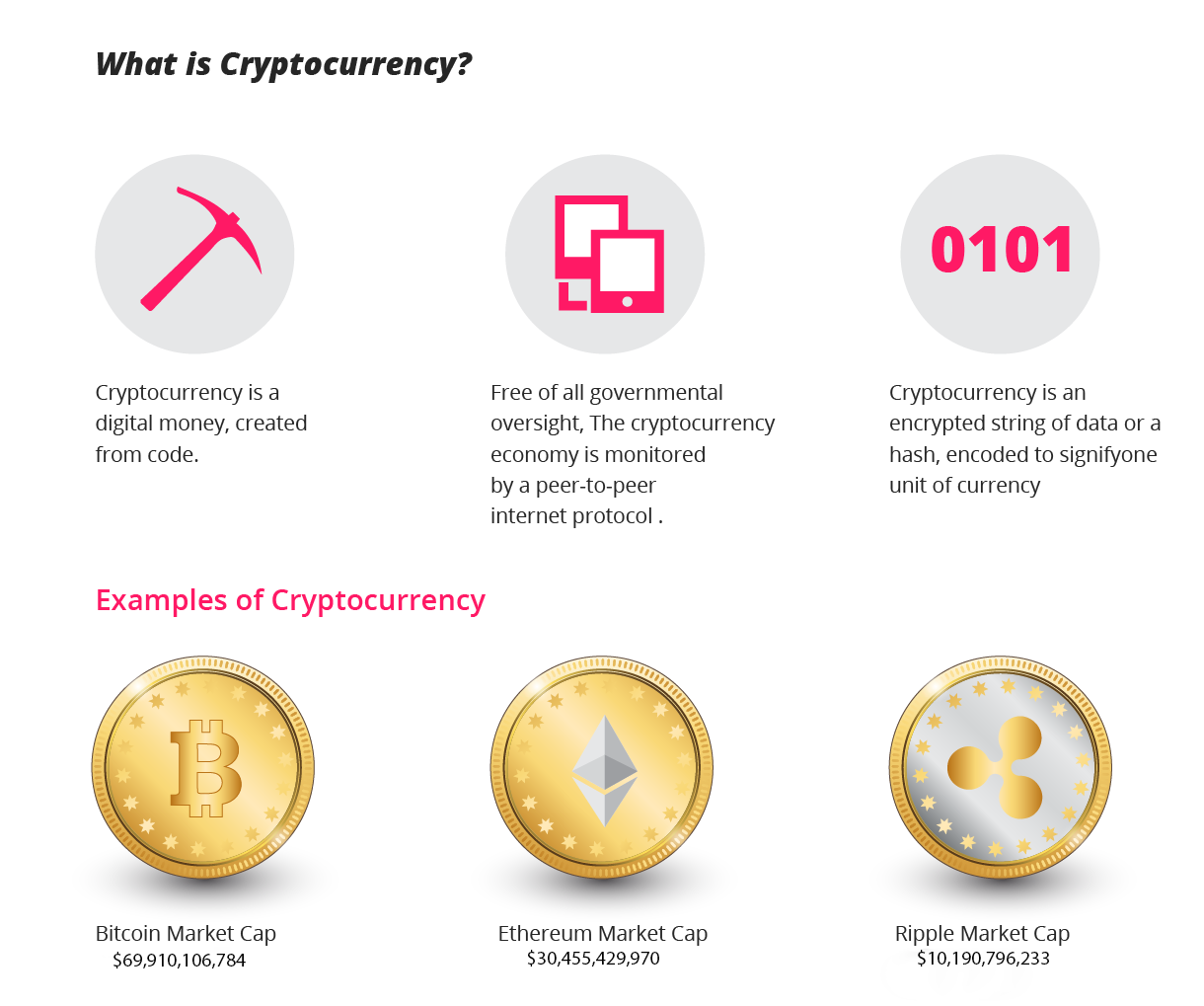

The entire cryptocurrency market — now worth more than $2 trillion — is based on the idea realized by Bitcoin: money that can be sent and received by anyone, anywhere in the world without reliance on trusted intermediaries, such as banks and financial services companies.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

The entire cryptocurrency market — now worth more than $2 trillion — is based on the idea realized by Bitcoin: money that can be sent and received by anyone, anywhere in the world without reliance on trusted intermediaries, such as banks and financial services companies.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

Cryptocurrency list

Hamster Kombat is just one of the many tap-to-earn games that have become extremely popular in recent months. Check the following list of bonuses and combos to maximize your winnings in your game of choice:

The most common forms of utility tokens are used for payment. However, their use may vary depending on the project. Examples of utility tokens are Filecoin, a utility token used on the digital storage platform,Siacoin, a token used on the cloud-storage platform, and Civic, a token used on the identity verification platform.

Recent research published by the United Nations University and Earth’s Future journal found that the carbon footprint of 2020-2021 bitcoin mining across 76 nations was equivalent to the emissions from burning 84 billion pounds of coal or running 190 natural gas-fired power plants. Coal satisfied the bulk of bitcoin’s electricity demands (45%), followed by natural gas (21%) and hydropower (16%).

Hamster Kombat is just one of the many tap-to-earn games that have become extremely popular in recent months. Check the following list of bonuses and combos to maximize your winnings in your game of choice:

The most common forms of utility tokens are used for payment. However, their use may vary depending on the project. Examples of utility tokens are Filecoin, a utility token used on the digital storage platform,Siacoin, a token used on the cloud-storage platform, and Civic, a token used on the identity verification platform.

Recent research published by the United Nations University and Earth’s Future journal found that the carbon footprint of 2020-2021 bitcoin mining across 76 nations was equivalent to the emissions from burning 84 billion pounds of coal or running 190 natural gas-fired power plants. Coal satisfied the bulk of bitcoin’s electricity demands (45%), followed by natural gas (21%) and hydropower (16%).