IG International Limited is licensed to conduct investment enterprise and digital asset enterprise by the Bermuda Monetary Authority. There are numerous buying and selling methods for speculating on CFDs, at least one for each buying and selling type. No, there isn’t a distinction – ‘currency CFDs’ is another term for foreign exchange CFDs, it’s precisely the identical thing. In trade lingo, collectively they’re known as “retail FX/CFD contracts“. Such high leverage ratios make CFDs particularly worth sensitive.

These are suitable for both newbie and superior merchants alike, and include an array of competitive leverage and margin requirements. A CFD commerce will show a loss equal to the scale of the spread on the time of the transaction. If the unfold is 5 cents, the stock needs to achieve 5 cents for the position to hit the breakeven worth.

Traders may also use these products to invest on the value moves in commodity futures contracts such as those for crude oil and corn. Futures contracts are standardized agreements or contracts with obligations to purchase or sell a selected asset at a preset value with a future expiration date. When you open a contracts for distinction (CFD) position, you select the variety of contracts (the trade size) you would like to purchase or promote. Your revenue will rise according to each point the market moves in your favour.

CfDs work by fixing the costs obtained by low carbon generation, lowering the risks they face, and guaranteeing that eligible expertise receives a worth for generated power that helps investment. CfDs also scale back prices by fixing the worth shoppers pay for low carbon electrical energy. This requires mills to pay money back when wholesale electricity prices are greater than the strike worth, and offers financial support when the wholesale electrical energy costs are decrease. While CFDs offer a gorgeous various to traditional markets, they also current potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small strikes. The dealer will pay a zero.1% fee on opening the position and one other 0.1% when the position is closed.

Cfds Distinction From Ftr

This is accomplished through a contract between client and broker and doesn’t utilize any stock, foreign exchange, commodity, or futures change. Trading CFDs presents several major advantages that have elevated the instruments’ monumental reputation up to now decade. With leveraged trading, you can short-sell the market in order to hedge against this downtrend possibility. If the market slides, what you lose in your portfolio may be offset by the gain out of your brief hedge utilizing CFDs.

A contract for difference (CFD) account allows you to trade on the worth distinction of various underlying belongings utilizing leverage. Leverage means you put up only a fraction of the amount https://www.xcritical.com/ wanted to trade. If you fail to keep up the margin requirement of your commerce, you’ll obtain a margin call from the CFD supplier asking you to deposit more funds in your account.

Comparability With Different Financial Instruments

If a dealer believes that the price of a currency pair will increase, they’ll open a long position, and if they believe it’ll lower, they will open a short place. The profit or loss is determined by the distinction between the opening and shutting prices of the contract. With CFD buying and selling, you don’t purchase or promote the underlying asset (for example a physical share, foreign money pair or commodity). Instead, you purchase or sell numerous models for a specific financial instrument, depending on whether you suppose prices will go up or down.

If you are risk-averse, then you can be in search of options with decrease risk-to-reward (R-R) ratios. Some regulators require that new customers pass an ‘appropriateness or suitability’ test. This often means answering some inquiries to demonstrate that you simply understand the risks of buying and selling on margin. It’s greatest to thoroughly educate yourself on how leverage and margin work before buying and selling. You should know that leverage trading can amplify your earnings, but can even enhance your losses.

What Are Contracts For Difference?

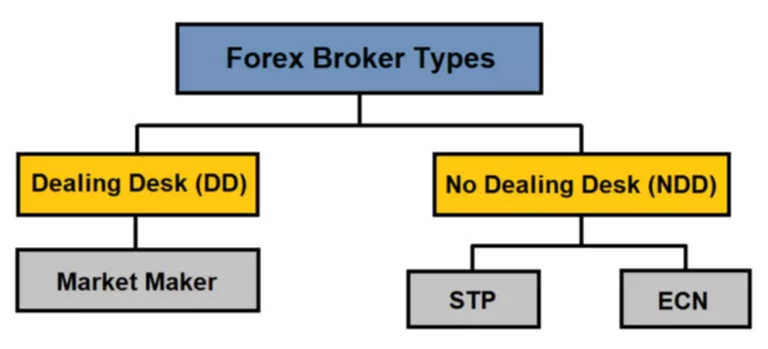

However, as your complete profit or loss is predicated on the full size of your place, both could considerably outweigh your margin amount. You should all the time take applicable risk management steps when buying and selling CFDs. Forex, also referred to as overseas change, is the most important financial market in the world, with trillions of dollars being traded every single day. It offers a fantastic alternative for investors to earn profits by speculating on the rise and fall of various currencies. One popular method to commerce forex is thru Contracts for Difference (CFDs). In this beginner’s information, we’ll discover what CFD trading is and how it works in the foreign exchange market.

- With proper education, practice, and discipline, CFD trading in forex could be a profitable enterprise for novices.

- It provides a great alternative for traders to earn profits by speculating on the rise and fall of different currencies.

- CFD trading in foreign exchange offers a flexible and accessible method for newbies to enter the foreign exchange market.

- CFDs are totally different in that there is no expiration date and you by no means own the underlying asset.

- You can commerce CFDs on shares, indices, ETFs, commodities and currencies, in addition to different smaller markets.

You’ll still trade the distinction in price between when your place is opened and when it’s closed but will earn a revenue if GBP/JPY drops in price and a loss if GBP/JPY will increase in price. CFDs are different from financial transmission proper (FTR)[27] in two ways. First, a CFD is often outlined at a particular location, not between a pair of areas.

Trade Cfds With A World, Award-winning Dealer

When it involves the speed we execute your trades, no expense is spared. Receive $50 for you and your good friend when you convert them into an lively dealer of ThinkMarkets. ThinkMarkets ensures excessive levels of shopper satisfaction with high shopper retention and conversion rates. Deepen your data of technical analysis indicators and hone your skills as a dealer.

For every point the value of the instrument moves in your favour, you achieve multiples of the number of CFD units you have bought or sold. For each point the worth strikes in opposition to you, you will make a loss. You’d purchase the pair should you expected the base foreign money to rise in worth in opposition to the quote foreign money. Before choosing an FX pair to trade, you want to carry out basic analysis and technical analysis on the two currencies within the pair. This means you must assess how the ‘base’ (the forex on the left) and the ‘quote’ (the foreign money on the right) transfer in relation to one another.

What’s One Difference Between A Contract For Differences (cfd) And A Futures Contract?

This allows speculators interested in diverse financial vehicles to trade CFDs as an different to exchanges. For example, suppose that a dealer wants to purchase CFDs for the share worth of GlaxoSmithKline. The trader expects that the share worth will improve to £24.80 per share.

Today the London School of Economics estimates that CFD trading accounts for more than a third of all stock market trades in the UK. Discover how the newest features can improve your market understanding and analysis. These apps enable cfd liquidity providers you to access the markets from the palm of your hand, wherever you go. Download today to handle your trades in seconds, view your buying and selling accounts and entry stay foreign money charges.

You’re all the time buying one currency and selling the other in the pair, based mostly on which forex you assume goes to understand in value in opposition to the opposite. The foreign money being bought is called the base forex (appears on the left), while the other known as the quote currency (appears on the right). CFDs are settled with money, however the notional amount is never physically exchanged. The only cash that actually switches hands is the difference between the worth of the underlying asset when the CFD is opened and when the CFD is closed. In each cases, when you shut your CFD position, your revenue or loss is the difference between the closing worth and the opening value of their CFD position. CFD buying and selling is the shopping for and promoting of contracts for difference (“CFDs”) via a web-based provider, who market themselves as “CFD providers“.